Importance of ERP Software in Financial Institutions!

In the present time, Enterprise Resource Planning (ERP) software has become one of the most cost-effective replacements of several time-consuming systems. Analyzing reports on sales, handling supply chain operations, monitoring project management activities, supervising human resource management, and others, a fully-functional ERP system can handle all daily activities faster and easier.

But above all this, having solid finance and accounting management is the lifeline of any industry. From determining the estimated budget to accomplish cash flows, everything is crucial to produce effective purpose-based trading decisions. And this is where an ERP financial system is changing the entire game of handling business’ finances and profitability.

Even many industries like banking sectors are widely using this software to attain effective processes. This OVER-THE-TOP system won’t only keep an eye on incoming and outgoing capitals but also improve the operational efficiency of modern businesses.

This isn’t only enough!

To determine the importance of the ERP system in financial institutions, we’ll provide a detailed guide over it. So, let’s get started.

Table of Content

Why is ERP Software is Essential in Financial Institutions?

- Perfectly Handle Accounting and Financial Requirements

- Less Human Errors

- Manage Billing and Payments on Time

- Richly Detailed Financial Reports

- Workflow Automation

- Avoid Duplicate Data Entry

- Provide High Financial Data Security

Why is ERP Software Essential in Financial Institutions?

Having an ERP system in a financial institution can improve cash flow, manage assets, create financial statements and reporting, handling all back-end financial management processes, and many more. As a result, a company gains the highest benefits, profitability, plus the maximum return on investment.

In contrast with that standalone accounting software, an ERP system is a more robust system that provides a clear picture of finances. Well, let’s have a look at the rest advantages of the ERP system in financial accounting.

● Perfectly Handle Accounting and Financial Requirements

Every financial institution requires a system that can easily manage finances actively. Whether it’s about making payments to vendors or paying wages to employees, an ERP system will handle everything. Through it, a business owner accesses all relevant business data and accurately defines the budget.

This further helps in distributing the right amount of cost on various activities, including purchasing raw materials, paying salary to employees, operational expenses, supplies, and many others. This single and fully-functional system lets you consolidate the data and bring it all together in one place. And managing multiple departments simultaneously means minimizing the time and cost spent on numerous tools.

● Less Human Errors

Generally, recording accounting data manually leads to various human errors, which further affects the overall business profitability. Wrong keyboard entries or misplacing the numbers are common data entry errors. Inappropriate accounting information and data input can extensively affect the status of financial analysis reports. It can further generate various accounting issues and tax implications. To resolve all these problems, an ERP system becomes a vital aspect to easily remove all data entry errors. Even the system can lessen the risk of inaccurate invoices, plus remove the other accounting problems.

● Manage Billing and Payments on Time

It’s impossible to manage billing, payments, and revenue at the same time. But, having a fully-fledged ERP system track the overall revenue of the business and customer payment schedules. Additionally, these systems are equipped with a feature that can perfectly integrate with the CRM (Customer Relationship Management) system.

Such a feature will lessen customer complaints and automate the business without any hassle. Its tracking capabilities and automated payment systems provide accurately measured billing, payments, and revenue. Although, the ERP system can handle investments, budgeting, cost analysis, profit tracking, and invoice tracking.

● Richly Detailed Financial Reports

A standalone accounting system doesn’t feature all functionalities. And thus, sometimes it lacks behind in various activities and is only obliged to offer basic features like balance sheets and income statements. In contrast, an ERP system generates a detailed financial report, which includes cash flow projections based on inventory management, order status, receivable, and many others.

All these will help in managing your business effectively. Moreover, an ERP system can take better control over the accounting department. It quickly and effectively generates accurate financial reports through its built-in and customizable features.

● Workflow Automation

An ERP system for accounting management has the ability to improve the core business operation. It’s built-in workflows and other time-saving features streamline the data input and make sure that your accounting is moving over the edge.

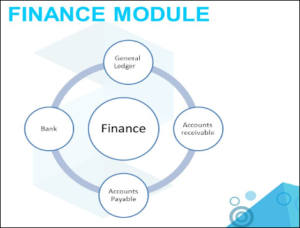

The system will automatically manage the various activities like accounts receivable and accounts payable, raises cash management, excludes cash flow problems, and others. Its finance and accounting module keeps an eye on various departments and brings accurate financial statements. This way, the system will accumulate the information and arrange it in a suitable way so you can manage your entire organization without any hassle.

● Avoid Duplicate Data Entry

A standalone system sometimes isn’t featured with all functionalities and allows to enter data manually from one to the other. As mentioned above, an ERP system combines all the business operations to manage its various processes. When you install such a system for your accounting department, it means you’re turning off your head from various hassles and risk management.

The system is capable enough to remove the tedious tasks and spread the information between different departments. You don’t need to enter the data manually. This further helps in improving data consistency and reduces duplicate data input errors. Hence, this makes the data entry quick and steady.

● Provide High Financial Data Security

In an organization, security over financial data is essential. It’s vital to keep such information highly confidential and secure in order to prevent yourself from fraudulent dealings and security breaches. But with the availability of modernized ERP software, a business owner can keep himself relaxed as the system is featured with multi-layer security. This feature allows the owner to store the information securely and provides role-based access to only authorized users.

Wrapping Up!

In the short-term, an ERP system combines all the data, customers, vendors, and processes to provide a smooth and productive workflow.

Now, you’re aware of the importance of ERP software. The various above-mentioned features available in an ERP system won’t only keep your organization ahead in the competition but also help in improving overall business performance.

So, what are you waiting for? Bring a fully-fledged Accpac accounting software to your organization and automate various processes without any interruption.

Thanks for reading!

Write For Us

Gain multichannel inventory visibility and control with eChannelHub

Learn more about eChannelHub with a free demo, tailored for your unique retail business.

Request A DemoRequest a Demo

Gain multichannel inventory visibility and control with eChannelHub

Learn more about eChannelHub with a free demo, tailored for your unique online business